By: Dipin Sehdev

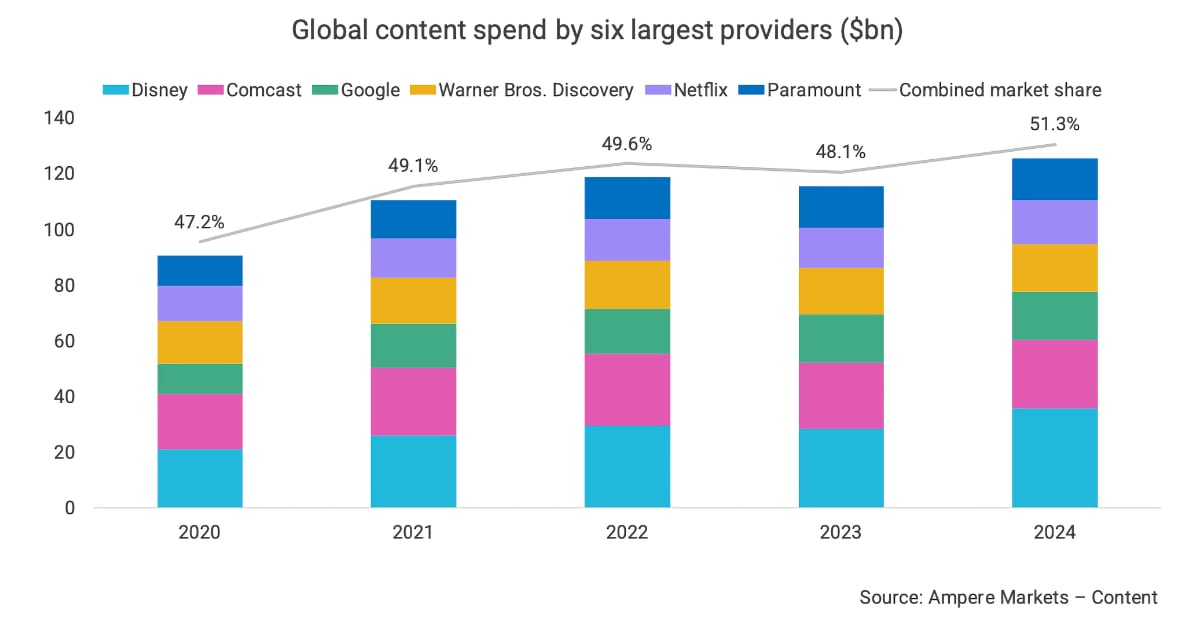

The global media landscape is undergoing a significant shift, driven by a surge in content spending by major players. This report dives into the key findings of a recent study by Ampere Analysis, focusing on the top six content spenders and the implications for viewers.

Key Players and Spending Breakdown

- Disney (14% of total spend): The entertainment giant remains the top spender, with an estimated investment of $35.8 billion in 2024. This significant increase is partly due to the full acquisition of Hulu, adding $9 billion to their budget. Their content spend includes theatrical films, streaming content (Disney+, Hulu, ESPN+), and regional sports rights (US).

- Comcast/NBCUniversal (9.9%): Following Disney with a projected $24.5 billion investment in 2024.

- Google (7.1%): Google's contribution comes primarily through YouTube and its revenue-sharing model with content creators. Their estimated spend is $17.6 billion in 2024.

- Warner Bros. Discovery (6.8%): This newly merged entity is projected to spend $16.8 billion in 2024 across its streaming services (HBO Max, Discovery+), cable channels, and film studios.

- Netflix (6.4%): Despite being the top investor in global streaming content with an average annual spend of $14.5 billion since the pandemic, Netflix ranks fifth overall in total content spending with a projected $16 billion in 2024. However, Ampere expects their spending to increase in 2025 due to recent acquisitions of sports rights (NFL, WWE).

- Paramount (6.1%): Rounding out the top six is Paramount with a projected spend of $15.1 billion in 2024. Interestingly, both Paramount+ and Netflix allocate a significant portion of their budget (40% and 52% respectively) to international content.

Content Spending Trends

- Overall Increase: Despite production disruptions caused by strikes, the top six companies are projected to spend a combined $126 billion in 2024, a 9% increase from 2023. This signifies a continued focus on content as a key differentiator in the competitive streaming market.

- Shifting Focus: While original content remains the leading spend type (45% since 2022), Ampere predicts a plateau in overall growth. Companies are expected to prioritize strategic investments and profitability, potentially leading to a decrease in commissioned content volume.

- Rise of Streaming: $40 billion of the projected $126 billion is earmarked for content specifically for subscription streaming services like Disney+, Peacock, Max, Paramount+, and Netflix. This highlights the growing importance of streaming platforms as viewers migrate away from traditional linear television.

- Global Content Strategy: Production shutdowns in the US have driven streamers to adopt a more global content strategy. International programming is often cheaper to produce and attracts new subscribers in niche markets. Netflix and Paramount+ are leading the way, with 52% and 40% of their budgets dedicated to non-US content, respectively.

The Future of Content

- Competition and Consolidation: With the top six companies controlling over half (51%) of the global content spending landscape, we can expect continued competition and potential consolidation in the media industry.

- Focus on Quality and Profitability: As growth plateaus, companies will likely prioritize content quality and profitability over sheer volume. This could mean more targeted content creation and a focus on building engaged audiences for specific genres and demographics.

- Rise of International Content: International content will likely continue to play a significant role, offering cost-effective production options and attracting new subscriber segments.

A Look at Streaming Services

Here's a table comparing the top streaming services mentioned in the report, including their subscription price, supported quality features (HDR, Dolby Vision, Dolby Atmos, DTX-X), and a brief note on their content strategy:

Streaming Service |

Monthly Price (USD) |

HDR |

Dolby Vision |

Dolby Atmos |

DTX-X |

Content Strategy |

| Disney+ | $7.99 (with ads), $15.99 (ad-free) | Yes | Yes | Yes | No |

Family-friendly content, Disney classics, Marvel, Star Wars, Pixar |

| Peacock | Free (limited) / $4.99 (ad-free) | Yes | Yes | Yes | No |

Free tier with limited content, ad-supported tier with more content, premium tier with all content and no ads |

| Max | $14.99 | Yes | Yes | Yes | Yes |

Warner Bros. films and TV shows, HBO content |

| Paramount+ | $4.99 (with ads), $9.99 (ad-free) | Yes | Yes | Yes | No |

Live sports, reality TV, original series and films |

| Netflix | $9.99 (Basic), $15.49 (Standard), $19.99 (Premium) | Yes | Yes | Yes | Yes |

Extensive library of original series and films, including international content |

| Apple TV+ | $6.99 | Yes | Yes | Yes | No |

Original series and films, including award-winning shows and movies |

Note:

- Prices and features may vary by region.

- Streaming services may add or remove content and features over time.

- Video and audio quality may vary depending on your internet connection, device, and plan.

Additional Considerations:

- Bundle Deals: Many streaming services offer bundle deals with other services, such as Hulu, ESPN+, and Showtime, at discounted rates.

- Free Trials: Some streaming services offer free trials to new subscribers.

- Student Discounts: Many streaming services offer student discounts.

- Parental Controls: Most streaming services offer parental controls to help you manage what your children watch.

Future Trends:

- Increased Competition: The streaming market is becoming increasingly competitive, with new services launching all the time.

- Focus on Original Content: Streaming services are investing heavily in original content to attract and retain subscribers.

- Ad-Supported Tiers: More streaming services are offering ad-supported tiers to attract price-sensitive consumers.

- Live Sports: Streaming services are increasingly acquiring rights to live sports events.

- AI and Machine Learning: AI and machine learning are being used to improve the user experience, such as personalized recommendations and content discovery.

Conclusion:

The streaming landscape is constantly evolving. By understanding the key players, content trends, and consumer preferences, you can make informed decisions about which streaming services are right for you.